Help Centre

Support > Ecommerce > Selling Online

Website Content - What Must I Include?

Presenting your company online means there are certain rules and regulations you must adhere to.

This guide outlines the key points you must remember, and how you can do this easily through your Create account.

What must I display on my website?

- Your Company details

- Accepted Methods of payment

- Your 'Terms and Conditions' – including Refunds Policy

Your Company details

You must clearly display your company's details for your customers. These details should include:

- Your company's registration name

- Your company's registered physical office address (inc. main country of domicile)

- Your company's place of registration

- Your company's registered number

- Your company's VAT number (if you are VAT registered)

- A contact telephone number

- An email address*

*The email address displayed should match the address given to your Payment Gateway provider, as this may be quoted in their receipts with you.

You may also like to include this information on your Contact Us page – see “How to set up the 'Contact' Page”.

Accepted methods of payment

Your website must display the logos of the payment methods that can be accepted through your shop.

Ideally, the logos should be displayed at the point of entry to your shop. This ensures your customers are aware of the payment types that you accept before they make a purchase*. We would recommend you feature these logos on the home page as well as throughout the checkout process.

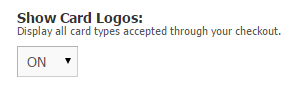

You can display the accepted payment logos in your Create footer. To enable this simply follow the steps below:

- Click 'Content' from the Top Menu

- Click 'Edit Site Footer' from the left-hand-side menu

- Under 'Show Card Logos' choose 'ON'

- Click 'Save Changes' and publish your site to see this live

You could display these logos in different places.

*You must only display the payment methods you are authorised to accept.

Your 'Terms and Conditions' – including Refunds Policy

Terms and Conditions (T's & C's):

Your T’s & C’s should be clearly displayed before a customer places an order – they should be accepted at the checkout to confirm purchase agreement.

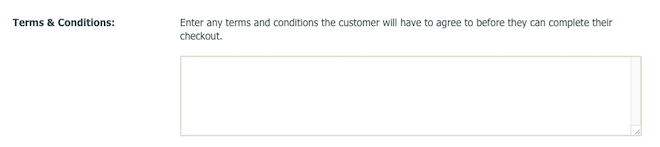

You can customise this information as you wish, and enable the setting for checkout confirmation by following the steps below in your Create account:

- Click on "Shop" from the Top Menu

- Click "Shop Settings" from the left-hand-side menu

- Choose "General Configuration" from the options

- Select "Checkout" from the tabs along the top

- Scroll down to the 'Terms & Condition' box and fill in

- Click the green "Save Changes" button to confirm

Please note: you will need to republish your site to see the changes live on your Shop.

You should also have a dedicated page accessible on your website. Well-drafted Terms and Conditions will offer absolute clarity on the terms of your service, what is to be agreed upon and what to do in a given situation. Not every policy will be the same – read our guide for more information on what to include.

Returns and Refunds Policy

Common practice is to include your Returns and Refunds policy within your standard Terms and Conditions. Your Refund Policy can be displayed anywhere on your site, as long as it is displayed before a customer makes a payment (see above).

Content you should include:

- How long you have to return an item from date ordered/received

- Condition of product eligible for return - new and unused

- Requirements - receipt or proof of purchase

- When can they expect refund

- Who is responsible for covering postage costs

- Your site and business information

- Items not eligible - including sale items

- How to return an item

- State if you are unable to provide substitute goods or services (as the case may be) of equivalent quality and price

Legal requirements for this policy may vary according to whether you are based in or out of the European Union (EU):

If you are based within the EU:

Where you are supplying consumers (i.e. individuals buying for themselves rather than for a business) you should make it explicit that the shopper has the right to cancel within seven days of their contract with you, or seven days of receipt of the goods (whichever is the longer). You must also explain that if the shopper does cancel their order, they will have their payment returned and outline the procedures they must follow to return their goods or services (these requirements ensure you comply with EU regulations). There are variations to these rules where you are supplying services or making customised goods.

If you are based outside the EU:

Local regulations may well apply and you should contact your local department of trade and commerce or a lawyer to find out what they are, but as a matter of good practice, if you do not accept returns you should include a statement making this clear to the shopper.

See the Electronic Commerce (EC Directive) Regulations 2002 for further details.

Processing payments

If you process credit and debit card payments through your ecommerce store, the company you choose to use will have requirements too. You should always ensure the products and services displayed on your website are representative of those you stated when signing up to their service.

These service providers may stipulate the following points are adhered to:

- The products and services that you intend to sell online must be clearly stated in your application and displayed on your website

- You must own or provide the goods or services you supply. You must not sell goods or services through this account on behalf of a third party

Please note: If you intend to sell products/services other than those stated on your original application form, you should request approval from your payment gateway provider before adding these to your website. For queries regarding the addition of new products and services to your website, please contact your payment gateway provider.

For more of an understanding of the laws and legal requirements that apply to you as a merchant offering goods or services, please see our guide for more information.

We recommend you seek independent financial and/or legal advice when writing your policies; and thoroughly read terms and conditions relating to any insurance, tax, legal, or financial issue, service, or product. The Trading Standards Institute are also there to support you.

Related Articles

More Questions?

If you have any further questions, please get in touch and we will be happy to help.

Get in Touch