Blog > The End of the U.S. De Minimis Exemption: What UK Small Businesses Need to Know

Disclaimer: This article does not constitute legal or financial advice. It reflects our understanding of the upcoming changes at the time of writing and is subject to change as more details are confirmed by regulators and shipping providers. Please seek specific guidance for your products and business.

What Is the De Minimis Exemption – and Why Is the U.S. Ending It?

Since 2016, the United States has allowed international parcels valued at $800 or less to enter duty-free under Section 321 of the Tariff Act of 1930. This is known as the de minimis threshold, and it has helped simplify customs and fuel cross-border e-commerce.

However, concerns about misuse, including tariff evasion and illicit goods entering through low-value shipments, have led President Trump to sign Executive Order 14324, which ends the de minimis exemption.

From 29 August 2025 (12:01 a.m. EDT) parcels and goods being imported into the USA will incur new tariffs and require full customs entry.

What Does This Mean for Your Online Store?

In practical terms, there's more paperwork and it will become more expensive for a U.S. customer to buy from you.

Import tariffs must be collected from your customer at checkout.

Your courier or postal service will pay the collected tariff to US Customs before the parcel enters the country.

Couriers may charge additional disbursement or handling fees for administering this on your behalf.

On top of this, every parcel will:

Require full customs entry (including accurate HS/commodity codes).

Face a risk of delays, fines, or rejection if paperwork is incomplete.

Potentially take longer to arrive with customers.

In short: every order shipped to the U.S. will now involve more cost, more admin, and more communication with customers subject to change as more details are confirmed by regulators and shipping providers. Please seek specific guidance for your products and business.

How Is It Calculated?

The executive order establishes two methods for collecting the IEEPA (International Emergency Economic Powers Act) tariff.

Ad Valorem duty : This is the duty assessed on the value of your shipment and charged at the tariff rate applicable to the Country of Origin for the product.

Specify duty (Also referred to as the Flat Rate scheme) : This is a set amount in US dollars depending on the tariff rate applicable to the Country of Origin for the product.

It’s worth noting that the Specific duty is an exception established in the Executive order to allow the International Postal Network more time to introduce the Ad Valorem duty. This exception applies for 6 months until the end of January 2026. After this time all orders shipped into the United States will need to comply with the Ad Valorem method.

How Much Will It Cost?

The total IEEPA Duty is calculated based on a number of factors:

The Country of Origin of your products

The Type of products you are shipping (the HS / USA Commodity Codes)

The courier or postal service that you use (Royal Mail, Parcelforce, DPD, FedEx etc)

There may also be other factors which impact your tariffs, so we recommend understanding if any additional charges apply because the tighter import process may flag other regulations or requirements as your parcel goes through US Customs.

To help make this clearer we’ve outlined two examples for you below:

Example: Sending Your Parcel With Royal Mail or Parcelforce

If your products are made in the UK, the U.S. tariff is a flat 10%. e.g. a greetings card (£5) so the percentage tariff will be 50p.

Please note that if your goods are manufactured in China or other countries, different (and often higher) tariff rates apply. These have been fluctuating in recent months, so it’s best to check rates regularly.

Example: Sending Your Parcel With International Couriers (FedEx, UPS, DHL)

Some international couriers are using the flat-fee (Duty Specific) scheme during the transition period. This exception is granted for use until the end of January 2026 and incurs the following charges based on your products Country of Origin:

$80 - when the country’s IEEPA rate is less than 16%

$160 - when the country’s IEEPA rate is between 16% and 25%

$200 - when the country's IEEPA rate is above 25%

Therefore, if you are sending your goods with a UK origin each parcel will incur an $80 flat rate charge. This is because the UK has a 10% IEEPA tariff rate.

Whilst the Ad Valorean method is likely to be less expensive for low-value parcels arriving in the United States, if you can't ship through Royal Mail (for example they don’t provide the right levels of insurance for your products), this may be the only option until the other carriers have built systems to handle the Ad Valorean method.

Some couriers also allow the customer to pay this flat fee on delivery, rather than you collecting it upfront. If this is an option you’re intending to use, communicating this so customers don’t get a shock is important. Otherwise you may find yourself with parcels being refused by customers and refunds requested.

We also recommend informing USA customers when ordering, or during the dispatch of their products, that there is the potential for slower than usual delivery due to the longer processes.

Do You Need to Update Your Website?

Yes, if you're continuing to ship your products to the USA we'd recommend adding (or updating) your information on Shipping & Duties so that it explains that from 29th August 2025, U.S. customer will be charged import tariffs. If you don't already make it clear that any additional charges or import fees are the customers responsibility, this is also worth including.

If you've decided to stop shipping your products to the USA through your online store, you could still invite potential American customers to get in touch through your Contact form and adding some information here can help them understand orders can still be placed if they contact you.

How Do I Charge IEEPA Tax in my store?

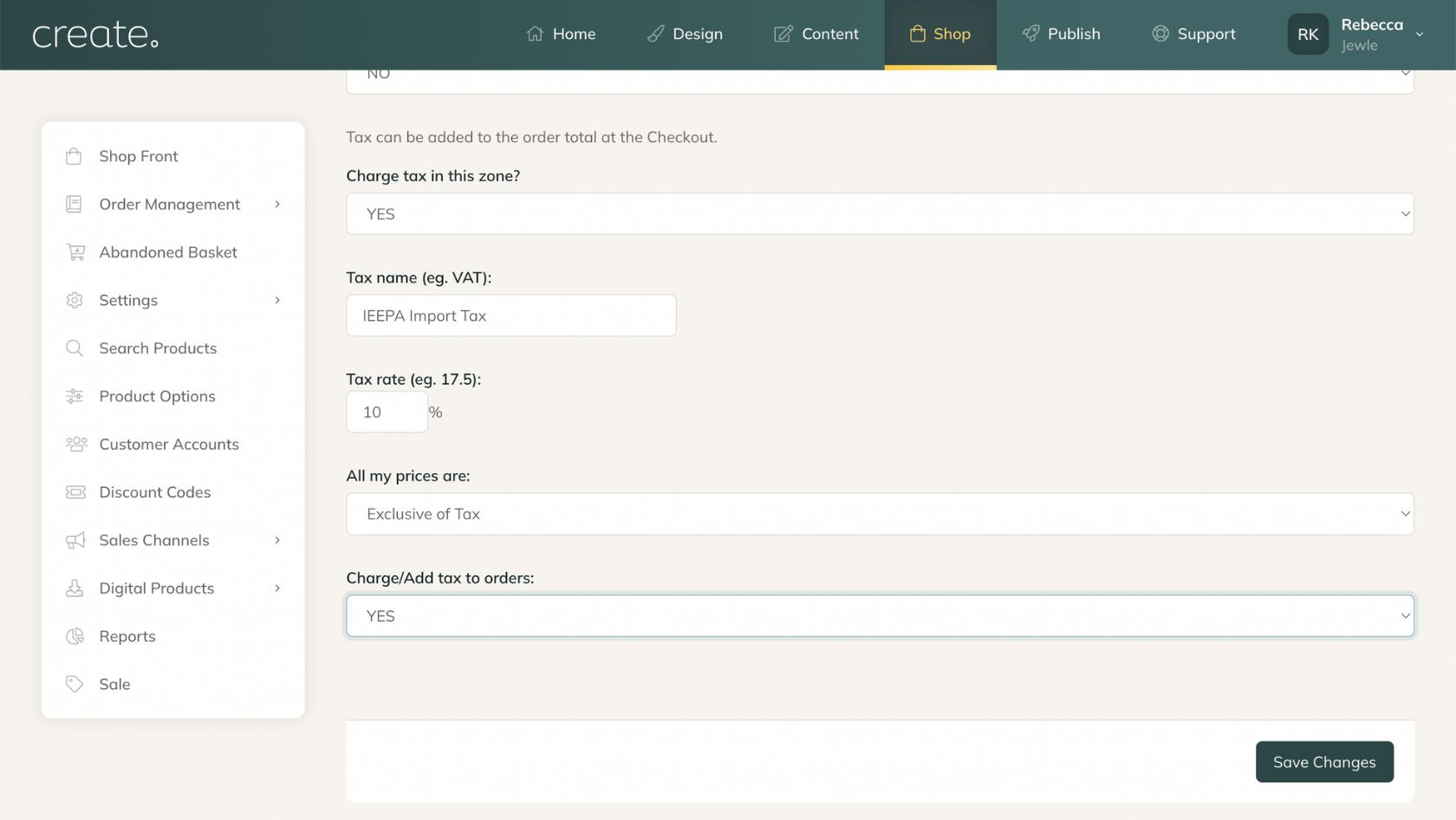

If your products are all manufactured or originate in the UK, then it’s straightforward to use the Create tax system to set up a 10% IEEPA tax on US orders. The checkout will then calculate the amount your customer needs to pay and clearly display it to them as part of the cost.

Similarly if all your products are of Chinese origin you could set the Chinese IEEPA tax rate to be collected.

Due to the short 6 month period that the flat rate scheme will run we won't be implementing a solution to capture the flat rate fee at the checkout. It's also not possible to configure tax collection if you have products from different countries of origin in your store at this time. We are investigating possible solutions for this and looking to clarify how this needs to work with regulators.

How to Set This Up in Your Create Store

If all your products originate from the same country (e.g. the UK), you can configure tariffs in your Create store by following the steps below:

From your Create dashboard, go to Shop on the top menu and Postage & Tax in the drop down.

Click on Edit Zone for the United States postage zone.

If you have the United States in a Zone with other countries you will create a United States postage zone.

Scroll past the country selection options for the Zone and s

elect Yes for the option Charge tax in this zone?

Complete the fields as you require for your specific setup. In the screenshot below you can see how a straight 10% IEEPA import tax can be setup.

Hit the Save Changes button.

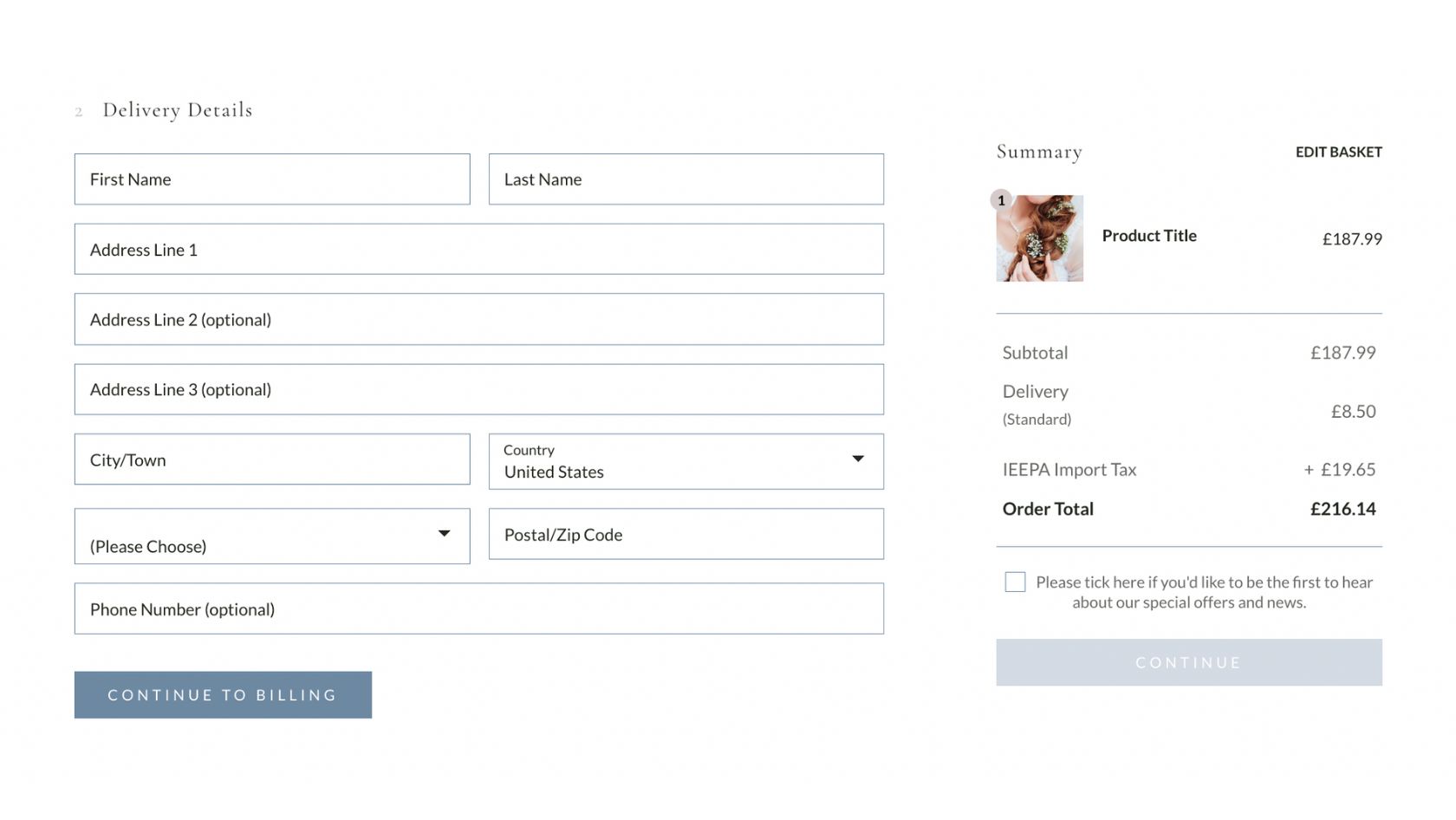

Once you've completed this process the tax for U.S. customers will be showing at the checkout.

The tax system calculates on the product price and delivery price, so you will collect slightly more tax than required when using this system. Therefore you could consider calling this a "tax and handling charge" at the checkout. This will help you cover some of the additional handling charges from Royal Mail and the other postal services .

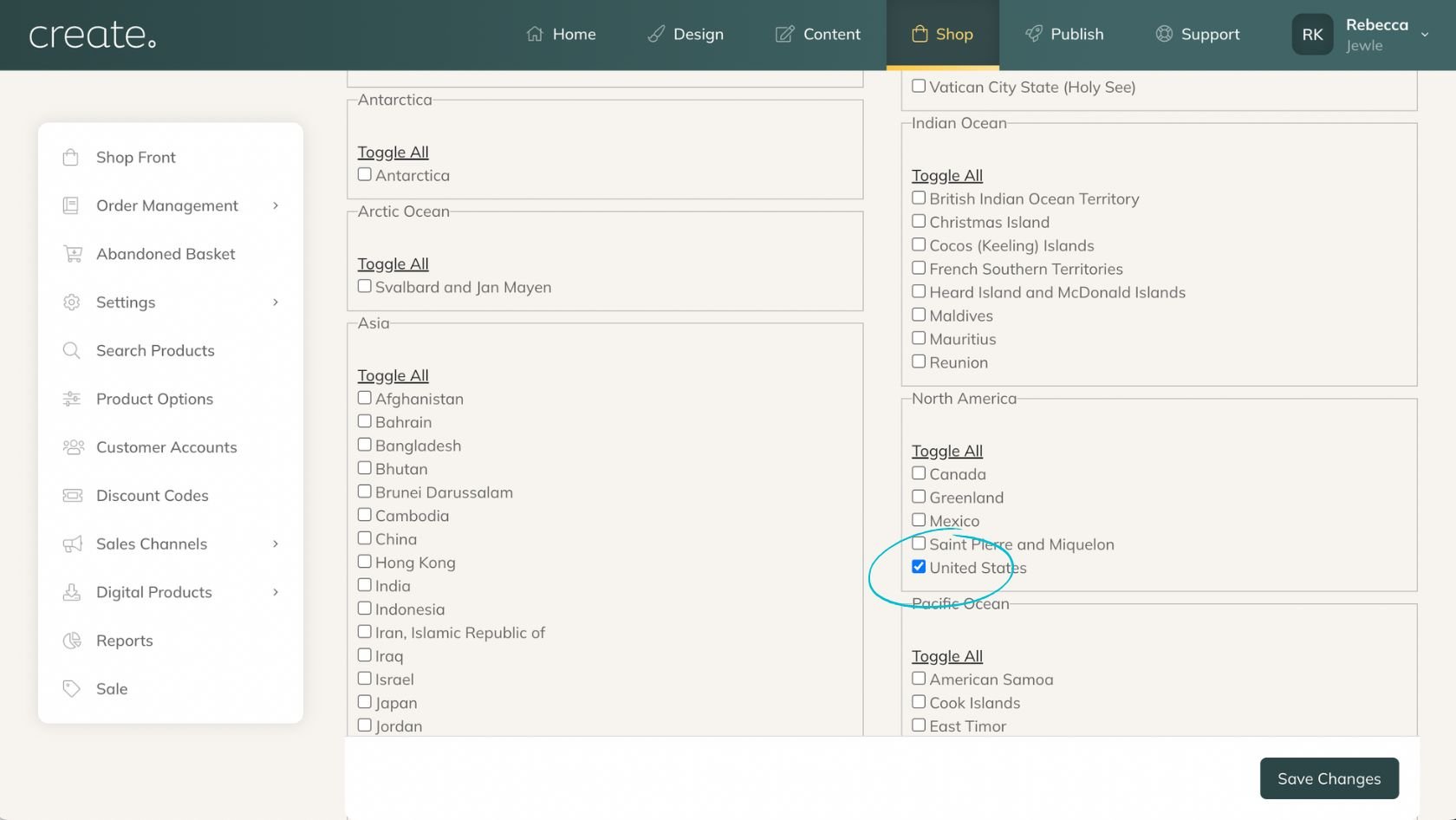

If you'd prefer to temporarily turn off shipping to the United States until there is more clarity around the processes and the charges this is also very easy to do.

From your Create dashboard, go to Shop on the top menu and Postage & Tax in the drop down.

Click on Edit Zone for the United States postage zone.

Untick the United States option (shown in the screenshot below).

Hit the Save Changes button.

Your store will no longer accept orders from customers in the United States and you can toggle this back on when you're ready to.

Wrapping Up

The end of the U.S. de minimis exemption is one of the biggest changes in cross-border ecommerce in recent years. For UK small businesses it means every parcel to the U.S. will attract tariffs, more compliance, regulations and systems to manage.

With so much up in the air it's still hard to know what to tell your customers so you can communicate the changes that are underway. Hopefully this article goes some way to clarifying what needs to be done and how to do it.

The next steps to take now are:

Review your supply chain and origin of goods.

Make any necessary changes to the postage and tax settings in your Create store.

Update your website and customer messaging.

Stay in touch with your courier or Royal Mail for updates.

Frequently Asked Questions

Do I have to stop selling to the U.S.?

No. You can still sell to U.S. customers, but you’ll need to make sure tariffs are accounted for at checkout or that your courier handles them on delivery. Some small businesses may choose to pause U.S. sales temporarily while systems are updated.

You can turn off shipping to the United States:

Here’s steps for how.

What if I only sell digital products?

Digital products (e.g. downloads, online services, subscriptions) are not physically imported and are not affected by de minimis tariffs. You can continue selling to U.S. customers without changes.

Will my U.S. customers have extra fees at delivery?

Not necessarily. If you collect tariffs at checkout (e.g. via Create’s tax settings) and your courier remits them to U.S. Customs, customers should not face additional charges. If you don’t collect tariffs in advance, your customer may be asked to pay on delivery.

What if my products come from more than one country?

Right now, we are seeking clarity on how orders with mixed origin goods are to be calculated. The postage and tax system can only apply a single tariff rate per postage country at checkout so if you stock goods from multiple origins, you’ll need to either:

Clearly explain that customers may face extra duties on mixed-origin orders and contact customers with a request for the taxes in advance of dispatching their order

Build the additional costs into your pricing structure (not recommended if the US is not a large part of your customer base)

Pause shipping to the U.S. while more clarification on charges is sought

Will delivery take longer?

Yes, it’s possible. Every parcel will now undergo a full customs entry process, which may slow delivery. Make sure to inform customers at checkout and in your shipping policy.

Glossary of Key Terms

With the end of the De Minimis exemption in the United States (29th August 2025), small businesses selling to U.S. customers now face a whole new set of rules, acronyms and industry terms. From IEEPA tariffs to DDP shipping, it can feel like a maze of jargon that’s hard to navigate. Especially if you’re a UK online store owner simply trying to keep orders moving.

To help, we’ve put together this quick-reference glossary. It explains the most important terms you’re likely to come across when shipping products to the U.S. after the rule change. Whether you’re talking to your courier, setting up your online store checkout, or answering customer questions, this resource should make it easier to understand the terminology being used.

Ad Valorem Duty

A tariff calculated as a percentage of the value of your goods (including postage). For example, if the duty is 10% and your order is worth £50 including shipping, the duty would be £5.

CBP - The US Customs and Border Protection

The U.S. authority responsible for overseeing imports, collecting tariffs, and enforcing customs rules.

CIF Price (Cost, Insurance, Freight)

The total price of goods including their cost, insurance during shipping, and freight charges. Tariffs are often calculated on the CIF price rather than just the product cost.

Commodity Code / HS Code

A classification system which provides specific numbers (or codes) to all types of products and is understood and used worldwide to classify goods for customs.

Country of Origin

The country where a product has originated, i.e. food grown or materials that were mined, or where the product was made or substantially transformed, i.e. wool from Switzerland knitted into a jumper. The Country of Origin determines which tariff rate is charged.

Customs Entry

The process of declaring goods to customs authorities when they enter a country. After 29 August 2025, all parcels sent to the U.S. will need full customs entry.

DDP - Delivery Duty Paid

The seller (you) pays all duties and taxes before shipping, so the buyer receives the parcel with no extra fees.

DDU - Delivery Duty Unpaid

The buyer pays duties and taxes when the parcel arrives. This can lead to unexpected costs and delays for your customer.

De Minimis Threshold

The value limit under which goods can enter a country without import duties. In the U.S., this was $800 but will end on 29 August 2025.

EXW (Ex Works) Price

The base price of the goods at the seller’s premises, not including shipping, insurance, or tariffs.

FPO - Fast Postal Operators

Major international couriers (like FedEx, UPS, DHL) that handle express cross-border shipping.

IEEPA (International Emergency Economic Powers Act)

A U.S. law that allows the government to impose emergency trade restrictions (including tariffs) for national security or trade reasons. The new U.S. import duties are being applied under this Act.

Import Tariff

A tax applied by a country on goods being imported. For the U.S., this will now apply to all parcels from the UK and other countries.

Landed Cost

The total cost of getting a product to the buyer, including the product price, shipping, insurance, tariffs, and any courier fees.

MFN - Most Favoured Nation

A trade principle where countries must charge the same tariff rates to all WTO members unless a specific trade deal applies.

PDDP - Postal Delivered Duties Paid

A postal shipping option where the seller collects and pays duties upfront, similar to DDP but specifically for postal operators.

Specific Duty (Flat Fee)

A temporary fixed charge (e.g. $80, $160, or $200 per parcel) based on the country’s tariff rate, available for six months from 29 August 2025 to 31 January 2026.

HTS - U.S. Harmonized Tariff Schedule

The U.S. tariff rulebook, listing all possible products and the duties that apply to them.

Value of Goods

The declared worth of the product being exported. This is what customs uses to help calculate tariffs.