Help Centre

Support > Ecommerce > Selling Digital Products

How to comply with 'EU Digital Services VAT' rules

As of 1st January 2021, the United Kingdom officially left the European Union. As part of this process, a trade agreement was established which detailed how tax should be accounted for on sales of products between the UK and the EU. Whilst there were some adjustments to the previous legislation for physical products, the legislation on digital products remained the same.

This means that businesses selling digital products/services must charge VAT at the point of consumption for all ‘Business to Consumer' (B2C) transactions i.e the resident country of the customer. If you are selling Digital Products through your Create account, you must comply with this legislation.

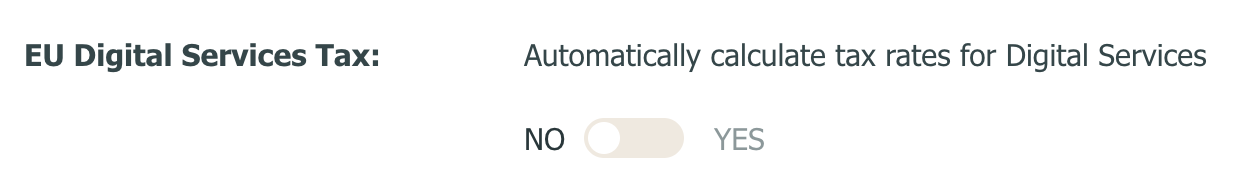

To help you with compliance, we have built functionality into our Digital Products feature that automatically calculates the customer’s VAT rate based upon their resident state for all digital products (this does not affect non-digital products you may be selling). This setting is turned off by default so it must be enabled within your account if you wish to use this tool.

How to turn on the 'EU Digital Services VAT' tool

To enable automatic calculation of EU Digital Services VAT on your downloadable products please follow the steps below:

- Log into your Create account

- Select “Shop” from the top menu

- Select “Digital Products" from the left-hand menu, followed by "Control Panel"

- Click the "Settings" tab at the top of this area

- Scroll down to “EU Digital Services Tax” and toggle the option to 'YES'

- Save changes

Setting product prices as 'Inclusive' or 'Exclusive' of VAT

You can set your sales to be 'inclusive' or 'exclusive' of VAT by turning VAT on/off in a particular zone or country.

If you haven't already enabled tax settings in your account, you can adjust this option by following the steps below:

- Log into your Create account.

- Select "Shop" from the top menu.

- Select "Settings" from the left-hand menu and then the "Postage & Tax" option.

- Click the edit icon beside the Delivery Zone you wish to modify. From here you can decide whether to charge VAT in this zone.

Choosing to set a zone as 'Inclusive' of VAT

If you select to not charge VAT in a zone, then the EU Digital Services VAT tool will calculate the final price to be inclusive of VAT (i.e. not added on to the total).

This means that if a product costs £10 then VAT is calculated within the total price. Therefore £10 is the final price charged to the customer, but a percentage of this will include the relevant VAT amount.

Choosing to set zone as 'Exclusive' of VAT

If you select to charge VAT in this zone, then the EU Digital Services VAT tool will add the relevant VAT to the customer's final price.

This means that if a product costs £10 excluding VAT, then VAT is added to this price. Therefore the final price is £10 + VAT.

Validating a customer's resident state

For VAT return purposes, you are required to validate your customers 'resident state' or country of residence with two pieces of non-conflicting evidence. The EU Digital Services VAT feature will automatically do this for you by verifying the billing address and IP address of your customer.

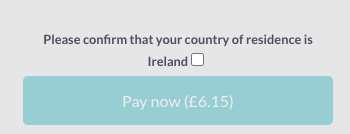

If the IP address and billing address conflict, your customer will be prompted to verify their billing address with an additional confirmation box.

The customer will be able to select the "Pay Now" button once they have confirmed their country of residence.

Related Articles

More Questions?

If you have any further questions, please get in touch and we will be happy to help.

Get in Touch